Your Step Pay Explained

Understanding how your pay is adjusted under the State of Colorado Step Pay system can be confusing, especially when job changes, trainee time, or breaks in service come into play. This page is here to help clarify how Step Rates work — including how your time-in-job series is counted and how cost-of-living adjustments (COLAs) affect your pay.

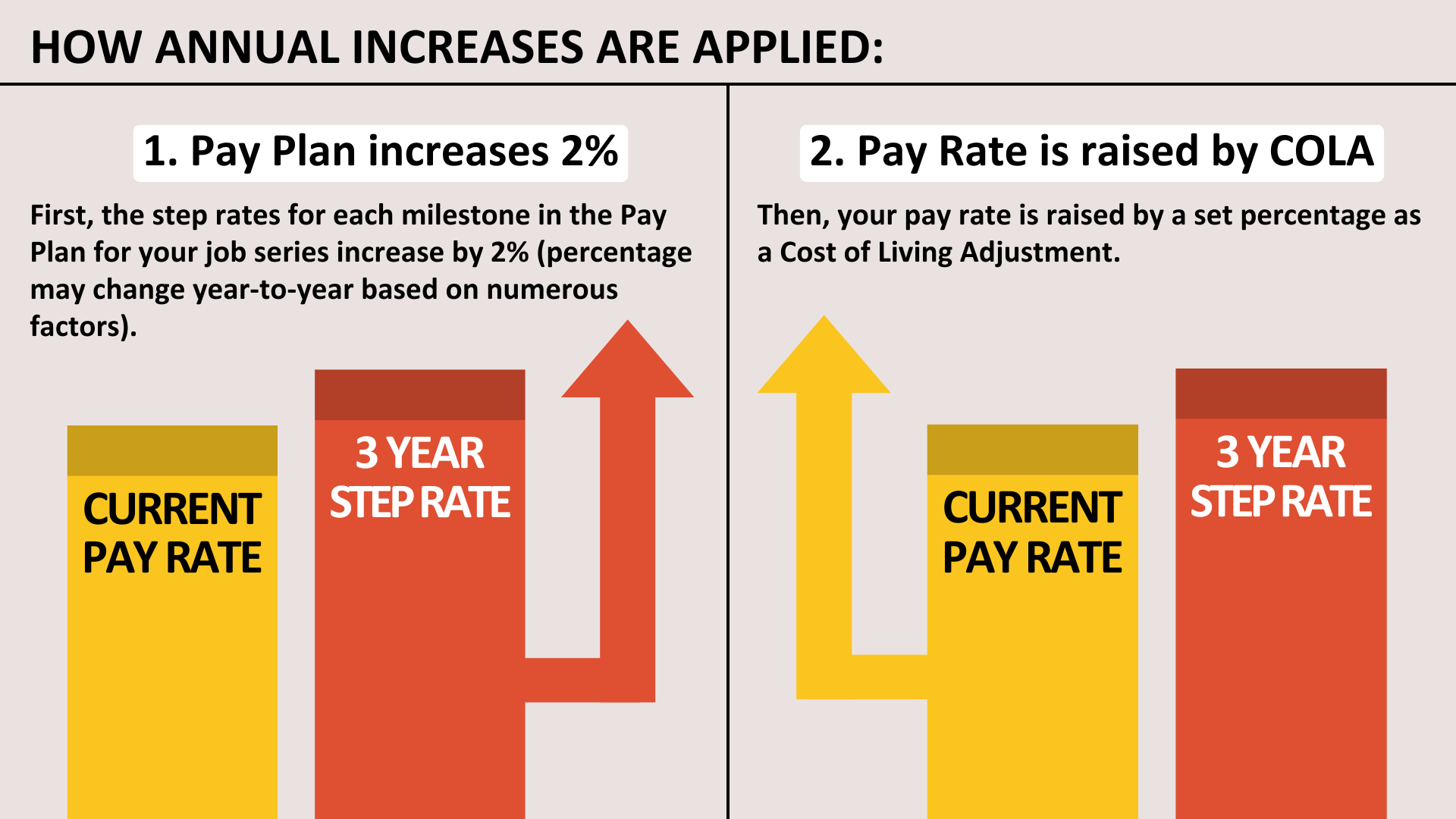

The infographic below provides a full overview of how annual increases are applied. Move through the slides for the big picture, or keep reading for a breakdown of each situation with additional details.

Download the Step Pay Infographic:

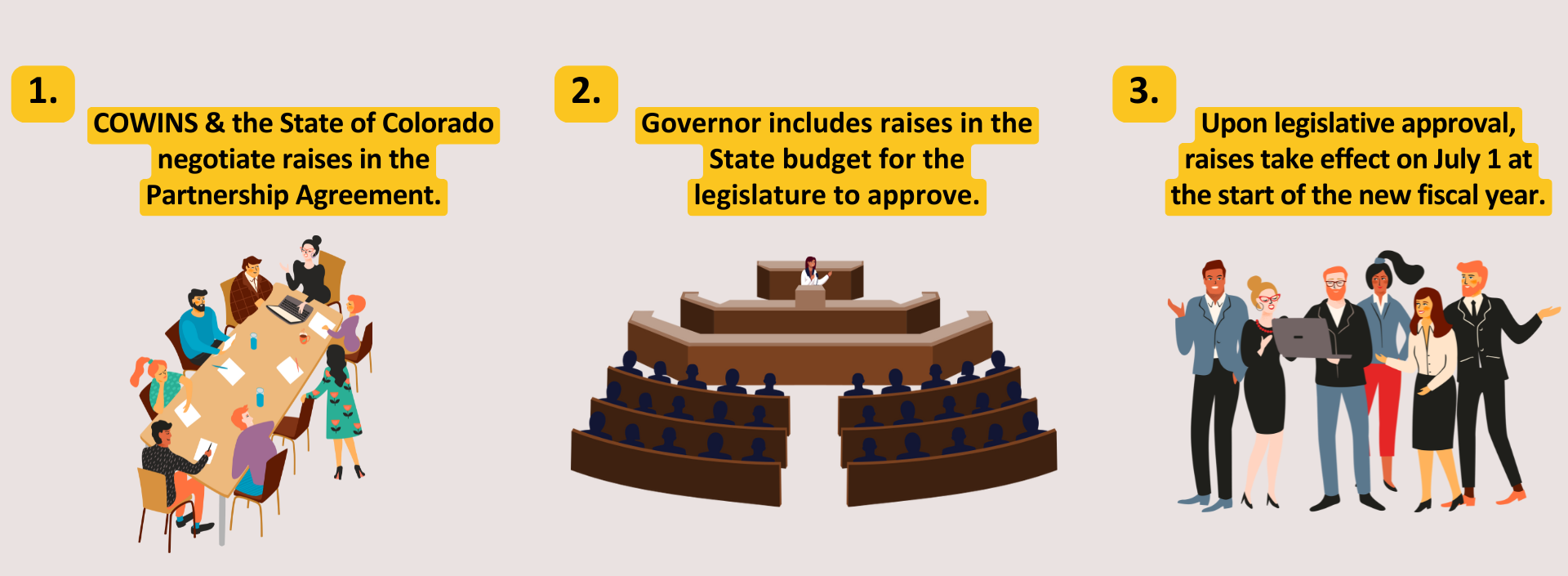

Understanding Legislative Approval

1. COWINS & the State of Colorado negotiate raises in the Partnership Agreement.

2. Governor includes raises in the State budget for the legislature to approve.

3. Upon legislative approval, raises take effect on July 1 at the start of the new fiscal year.

From the FAQ – Each year, the salary increases bargained by the State of Colorado and COWINS in the Partnership Agreement are included in the Governor’s budget. The State Legislature then votes whether to approve this budget, after which the increases are applied on July 1st of the new fiscal year.

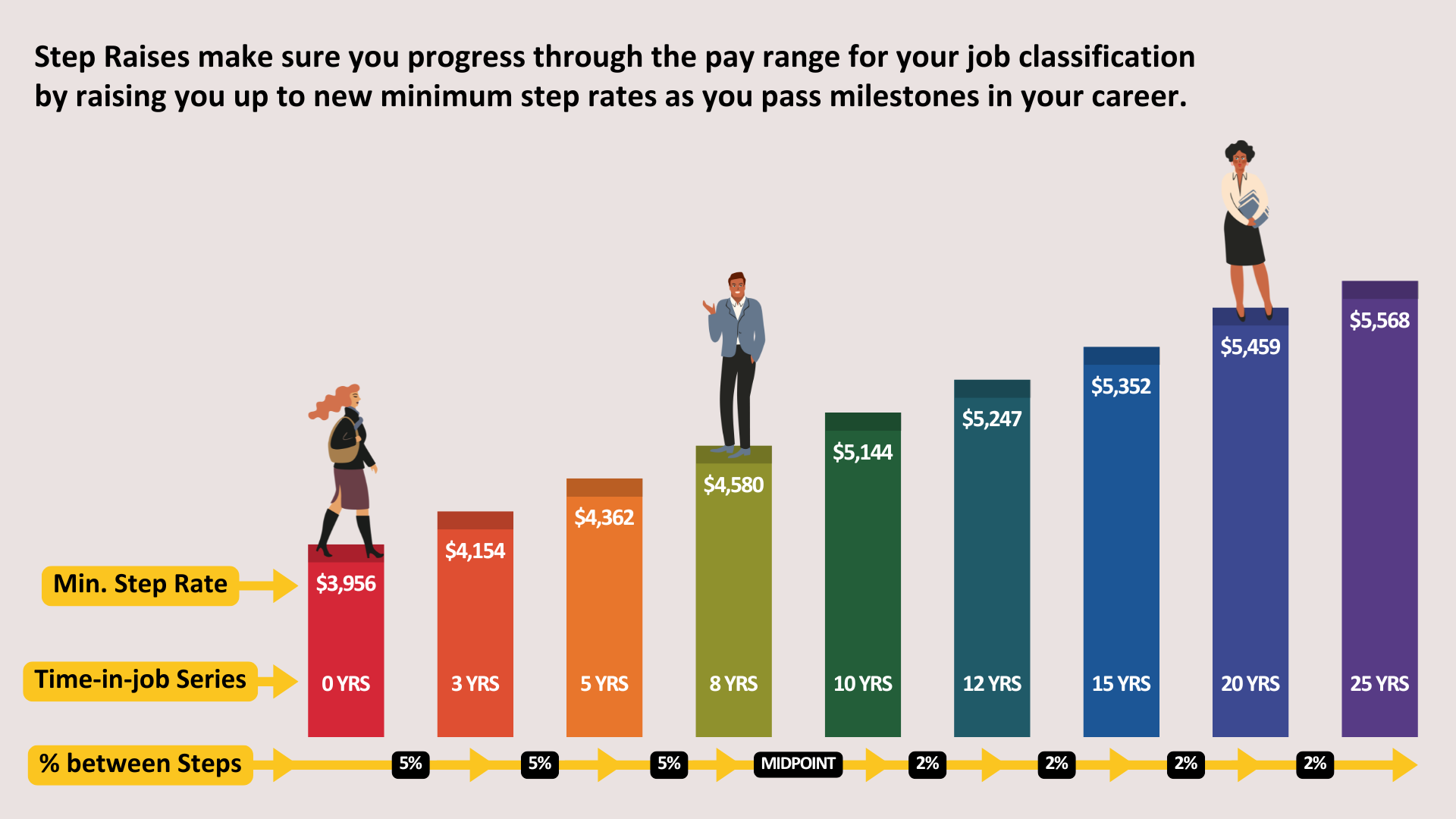

Updated Step Rates

Step Raises determine your minimum pay rate based on your time in your current job series. Each time you pass a new milestone in the Pay Plan, your minimum step rate goes up based on the milestones laid out in the Partnership Agreement.

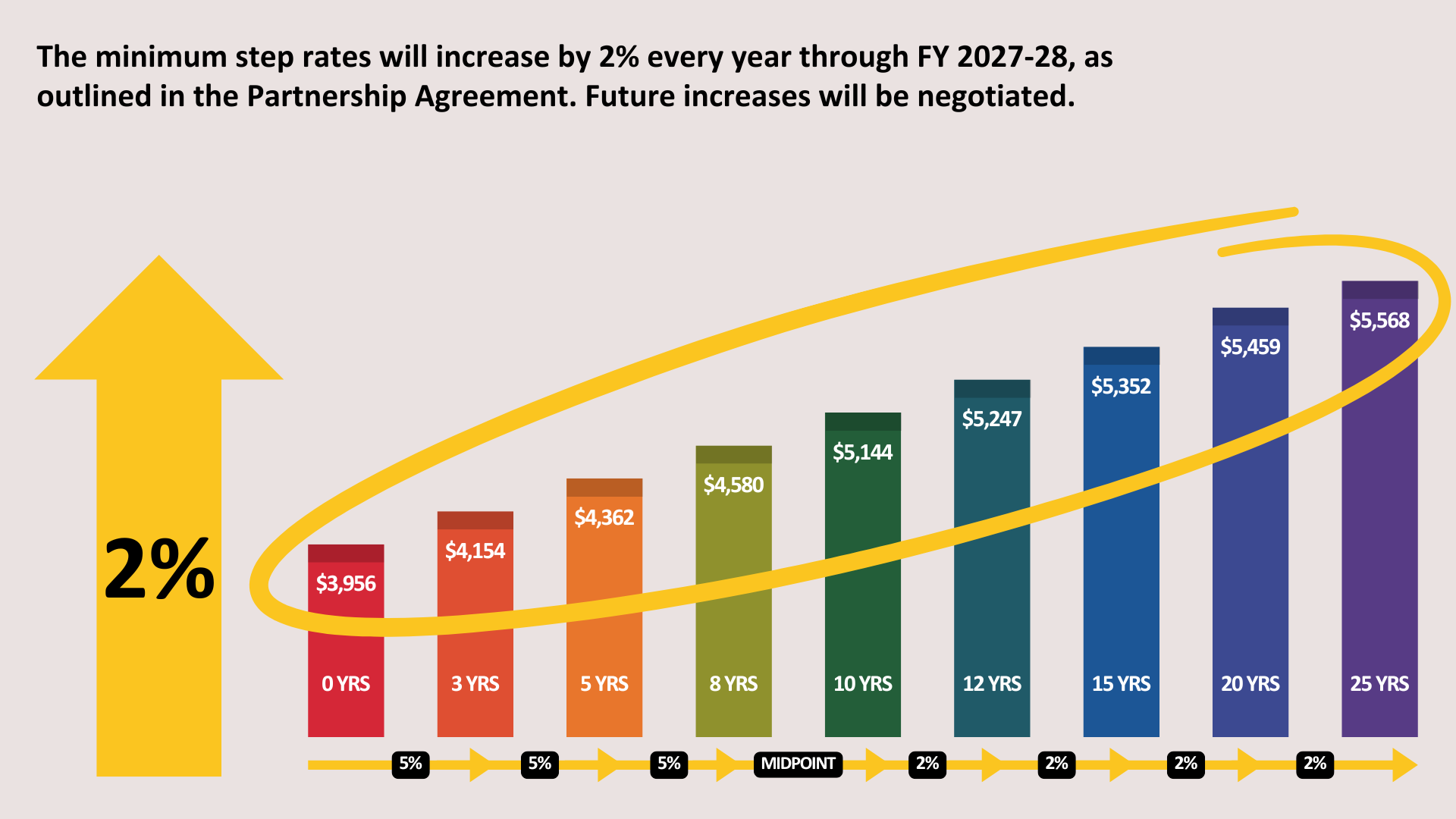

Pay Plan Increase Applied

When the State increases the Pay Plan Structure, each Step Rate for every milestone in your job series goes up. For example, a 2% increase means all the Step Rates move up by 2%.

Order of Steps Operations

Scenarios:

1. Pay Plan increases 2%

First, the Step Rates for each milestone in the Pay Plan for your job series increase by 2% (percentage may change year-to-year based on numerous factors).

2. Pay Rate is raised by COLA

Then, your Pay Rate is raised by a set percentage as a Cost of Living Adjustment (COLA), pending annual legislative approval.

Adjusting Pay if Needed

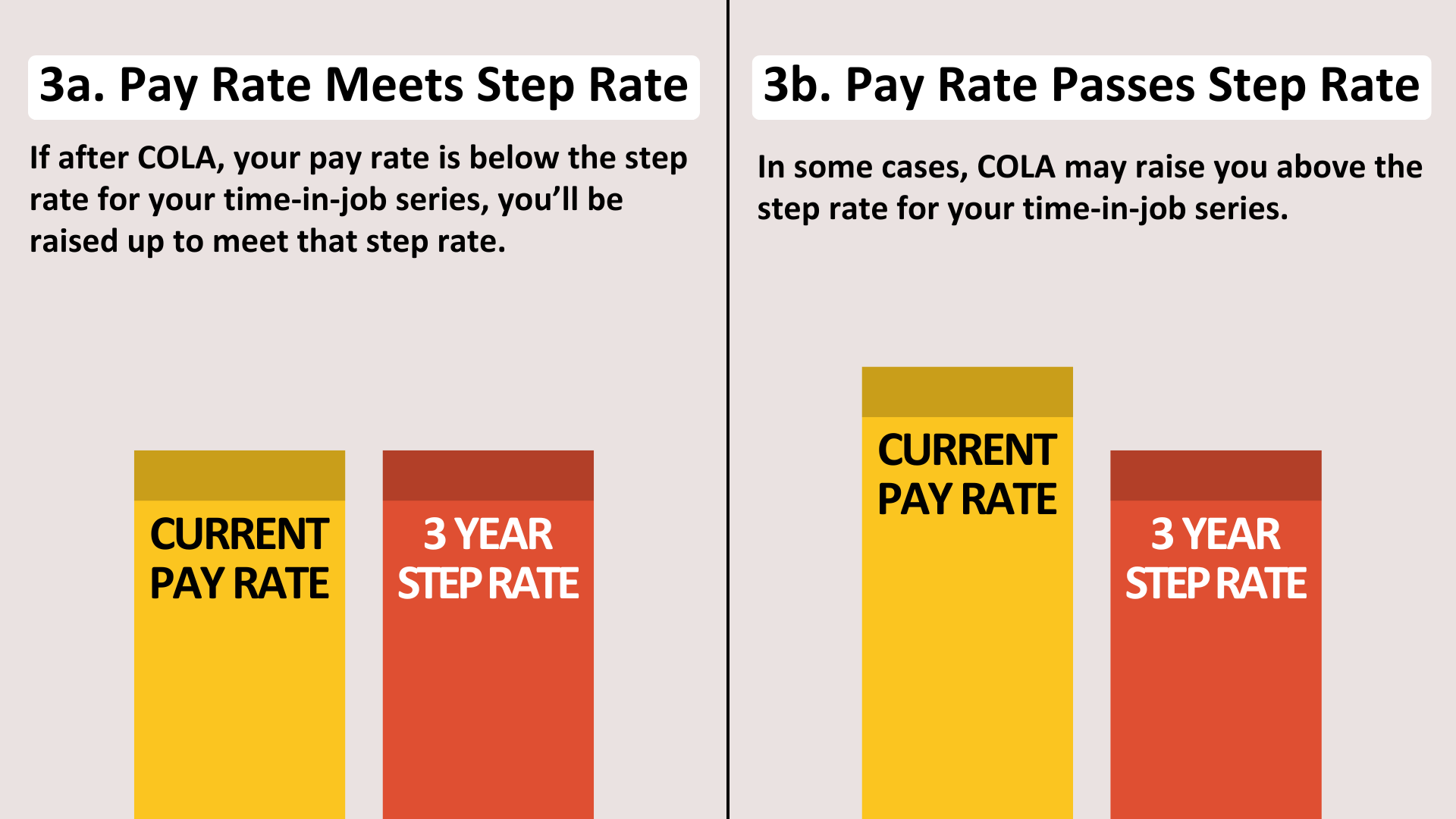

3a. Pay Rate meets Step Rate

If after COLA, your Pay Rate is below the Step Rate for your time-in-job series, you’ll be raised up to meet that Step Rate.

3b. Pay Rate passes Step Rate

In some cases, COLA may raise you above the Step Rate for your time-in-job series.

If You Changed Jobs

(Consider: “What Happens When You Change Jobs Within or Outside a Job Series”)

If you change job classification, but stay in the same job series, your previous years of service count towards Steps. If you move to a job classification in a different series, those years don’t count towards time-in-job series.

Example:

Health Prof. I (4 years of service) → Nurse III → Health Prof. II (2 years of service)

= 6 years in job series

Result: You’d use the 5-year Step Rate as the minimum rate of pay.

| Time-in-job series | Step | Step Rate | Min. Step Rate |

|---|---|---|---|

| 0–2 years | Step 0 | Pay range minimum | $4,797 |

| 3–4 years | Step 3 | Pay range minimum + 5% | $5,037 |

| 5–7 years | Step 5 | Step 3 + 5% | $5,289 |

| 8–9 years | Step 8 | Step 5 + 5% | $5,553 |

| 10–11 years | Step 10 | Pay range midpoint | $5,757 |

| 12–14 years | Step 12 | Step 10 + 2% | $5,872 |

| 15–19 years | Step 15 | Step 12 + 2% | $5,989 |

| 20–24 years | Step 20 | Step 15 + 2% | $6,109 |

| 25 years or more | Step 25 | Step 20 + 2% | $6,231 |

Min. Step Rate shown is for Health Professional II in the FY2024–25 Pay Plan.

If You Left State Service

Previous years of service before you left the State counts, but ONLY if you’re returning to the same job series you were in previously.

Accountant II (4 years of service) → left state service → Accountant III (5 years of service)

= 9 years in job series

Result:You'd use the 8-year Step Rate as the minimum rate of pay.

| Time-in-job series | Step | Step Rate | Min. Step Rate |

|---|---|---|---|

| 0–2 years | Step 0 | Pay range minimum | $6,767 |

| 3–4 years | Step 3 | Pay range minimum + 5% | $7,105 |

| 5–7 years | Step 5 | Step 3 + 5% | $7,460 |

| 8–9 years | Step 8 | Step 5 + 5% | $7,833 |

| 10–11 years | Step 10 | Pay range midpoint | $8,797 |

| 12–14 years | Step 12 | Step 10 + 2% | $8,973 |

| 15–19 years | Step 15 | Step 12 + 2% | $9,152 |

| 20–24 years | Step 20 | Step 15 + 2% | $9,335 |

| 25 years or more | Step 25 | Step 20 + 2% | $9,522 |

Min. Step Rate shown is for Accountant III in the FY2024–25 Pay Plan.

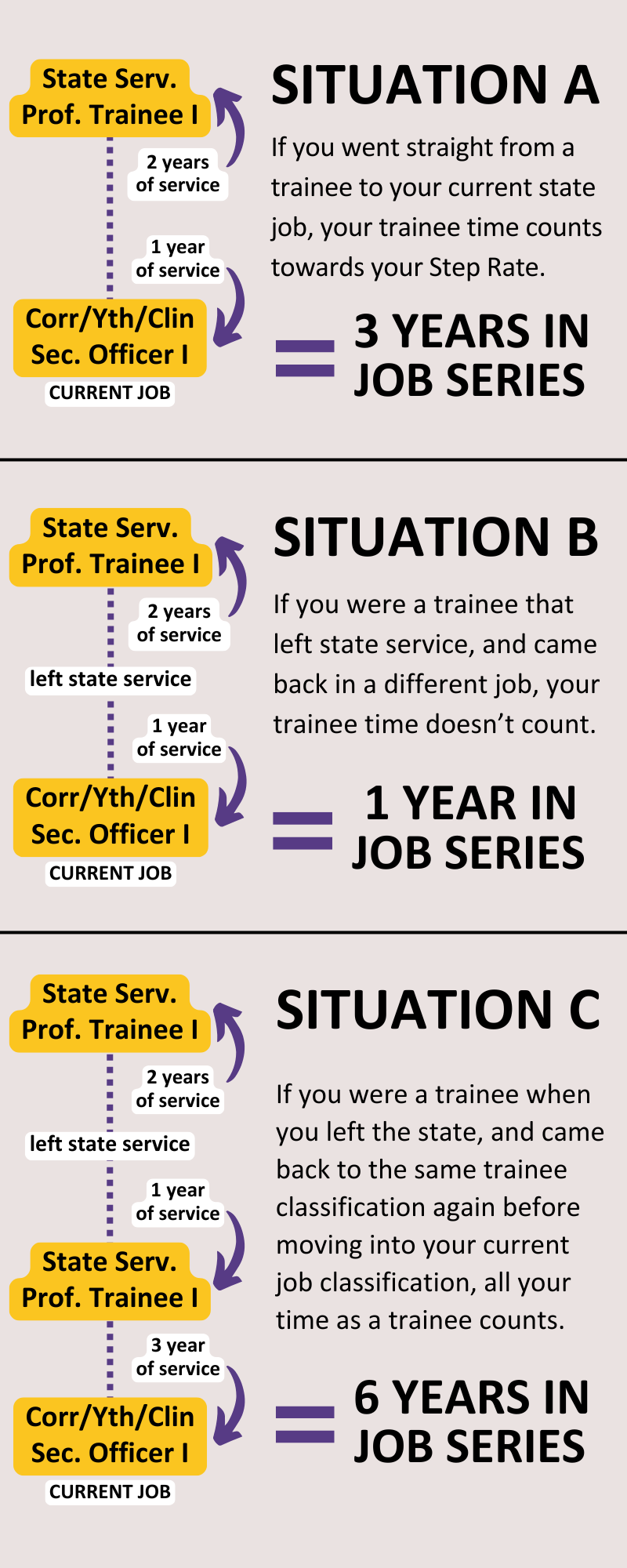

If You Were a Trainee

For your time as a trainee to count towards time-in-job series, you need continuity of service — meaning no break in service between the trainee series time and the series immediately following the trainee classification.

Situation A — Continuous Service

If you went straight from a trainee to your current state job, your trainee time counts towards your Step Rate.

State Serv. Prof. Trainee I (2 years of service)

→ Corr/Yth/Clin Sec. Officer I (1 year of service)

= 3 years in job series

Situation B — Break in Service

If you were a trainee that left state service, and came back to a different job classification, your trainee time doesn’t count.

State Serv. Prof. Trainee I (2 years of service)

→ left state service

→ Corr/Yth/Clin Sec. Officer I (1 year of service)

= 1 year in job series

Situation C — Return to Same Trainee Series

If you were a trainee when you left the state, and came back to the same trainee series again before moving into your current job classification, all your time as a trainee counts.

State Serv. Prof. Trainee I (2 years of service)

→ left state service

→ State Serv. Prof. Trainee I (1 year of service)

→ Corr/Yth/Clin Sec. Officer I (3 years of service) (current job)

= 6 years in job series

*Both trainee positions must be part of the same trainee job series for your time to count.

*If you return to the same trainee series, all your time counts — once you move into a role that’s part of the Step Pay Plan.